Latest Updates: LPTV Stock Forecast And Analysis

What is LPTY Stock? LPTY stock is an exchange-traded fund (ETF) that tracks the performance of the S&P 500 index. It is designed to provide investors with exposure to the U.S. stock market in a single investment.

LPTY stock is a popular choice for investors who are looking for a diversified investment with a low expense ratio. It is also a good option for investors who are new to the stock market and want to gain exposure to a wide range of companies.

LPTY stock has been a strong performer over the long term. Since its inception in 2003, it has returned an average of 10% per year. This has made it a popular choice for investors who are looking for a long-term investment.

Read also:Bridgit Mendler A Path To Education And Success

LPTY Stock

Introduction: Highlighting the importance of the key aspects.Key Aspects:- Diversification: LPTY stock provides investors with exposure to a wide range of companies, which helps to reduce risk.

- Low expense ratio: LPTY stock has a low expense ratio, which means that investors can keep more of their returns.

- Long-term performance: LPTY stock has been a strong performer over the long term, which makes it a good option for investors who are looking for a long-term investment.

LPTY Stock

LPTY stock is an exchange-traded fund (ETF) that tracks the performance of the S&P 500 index. It is designed to provide investors with exposure to the U.S. stock market in a single investment.

- Diversified: LPTY stock provides investors with exposure to a wide range of companies, which helps to reduce risk.

- Low-cost: LPTY stock has a low expense ratio, which means that investors can keep more of their returns.

- Long-term growth: LPTY stock has been a strong performer over the long term, which makes it a good option for investors who are looking for a long-term investment.

- Tax-efficient: LPTY stock is tax-efficient, which means that investors can defer paying taxes on their gains until they sell their shares.

- Liquid: LPTY stock is liquid, which means that investors can easily buy and sell their shares.

- Transparent: LPTY stock is transparent, which means that investors have access to information about the fund's holdings and performance.

These key aspects make LPTY stock a good option for investors who are looking for a diversified, low-cost, long-term investment. LPTY stock has been a strong performer over the long term, and it is expected to continue to be a good investment for years to come.

Diversified

Diversification is an important investment strategy that can help to reduce risk. By investing in a diversified portfolio of stocks, investors can reduce the impact of any one stock's performance on their overall portfolio.

LPTY stock is a diversified ETF that provides investors with exposure to a wide range of companies. This diversification helps to reduce the risk of investing in any one company or sector.

For example, if an investor invests in a single company, they are exposed to the risk that the company may perform poorly. However, if the investor invests in a diversified portfolio of stocks, they are less exposed to this risk because the performance of one company is less likely to have a significant impact on the overall portfolio.

Diversification is an important investment strategy that can help to reduce risk. LPTY stock is a diversified ETF that provides investors with exposure to a wide range of companies. This diversification helps to reduce the risk of investing in any one company or sector.

Read also:Hollywoods Rising Star The Captivating Jurnee Smollett

Low-cost

A low expense ratio is important because it means that investors can keep more of their returns. This is because the expense ratio is a fee that is charged by the fund manager to cover the costs of managing the fund. A higher expense ratio means that the fund manager will take a larger portion of the fund's returns, leaving less for investors.

LPTY stock has a low expense ratio of 0.09%. This means that investors can keep more of their returns. For example, if an investor invests $10,000 in LPTY stock and the fund returns 10% over the year, the investor will keep $991 in returns. However, if the fund had a higher expense ratio of 1%, the investor would only keep $980 in returns.

Over time, a low expense ratio can make a significant difference in the amount of money that an investor earns. This is why it is important to consider the expense ratio when choosing an ETF.

Long-term growth

LPTY stock has been a strong performer over the long term, with an average annual return of 10% since its inception in 2003. This makes it a good option for investors who are looking for a long-term investment.

- Consistent returns: LPTY stock has a history of delivering consistent returns, even during periods of market volatility. This is due to the fund's diversified portfolio, which includes a wide range of companies in different sectors.

- Low expenses: LPTY stock has a low expense ratio of 0.09%, which means that more of the fund's returns are passed on to investors. This makes LPTY stock a more cost-effective option than many other ETFs.

- Tax efficiency: LPTY stock is tax-efficient, which means that investors can defer paying taxes on their gains until they sell their shares. This can be a significant advantage for investors who are in a high tax bracket.

- Liquidity: LPTY stock is a liquid ETF, which means that investors can easily buy and sell their shares. This makes LPTY stock a good option for investors who need to access their money quickly.

Overall, LPTY stock is a good option for investors who are looking for a long-term investment with consistent returns, low expenses, and tax efficiency. LPTY stock is also a liquid ETF, which makes it a good option for investors who need to access their money quickly.

Tax-efficient

LPTY stock is tax-efficient because it is an exchange-traded fund (ETF). ETFs are taxed differently than mutual funds. When an investor sells shares of an ETF, they are only taxed on the gains that they have realized. This means that investors can defer paying taxes on their gains until they sell their shares.

- Title of Facet 1: Deferral of capital gains taxes

When an investor sells shares of LPTY stock, they are only taxed on the gains that they have realized. This means that investors can defer paying taxes on their gains until they sell their shares. This can be a significant tax savings for investors who are in a high tax bracket.

- Title of Facet 2: Step-up in basis

When an investor dies, their heirs receive a step-up in basis for the LPTY stock. This means that their heirs will not have to pay taxes on the gains that accrued before the investor died. This can be a significant tax savings for heirs who inherit LPTY stock.

- Title of Facet 3: No state or local taxes

LPTY stock is not subject to state or local taxes. This can be a significant tax savings for investors who live in states or localities with high taxes.

- Title of Facet 4: Qualified dividends

LPTY stock pays qualified dividends. Qualified dividends are taxed at a lower rate than ordinary dividends. This can be a significant tax savings for investors who receive qualified dividends.

Overall, LPTY stock is a tax-efficient investment. Investors can defer paying taxes on their gains until they sell their shares, and they can also benefit from a step-up in basis, no state or local taxes, and qualified dividends. These tax benefits make LPTY stock an attractive investment for investors who are looking to minimize their tax liability.

Liquid

Liquidity is an important factor to consider when investing in any asset. A liquid asset is one that can be easily bought or sold without significantly affecting its price. LPTY stock is a liquid asset because it is traded on a major stock exchange, which means that there is always a ready market for buyers and sellers.

- Title of Facet 1: Trading volume

One of the key factors that determines the liquidity of a stock is its trading volume. Trading volume refers to the number of shares that are traded each day. LPTY stock has a high trading volume, which means that there is always a large number of buyers and sellers in the market. This makes it easy for investors to buy or sell LPTY stock without significantly affecting its price.

- Title of Facet 2: Bid-ask spread

Another factor that affects the liquidity of a stock is its bid-ask spread. The bid-ask spread is the difference between the highest price that a buyer is willing to pay for a stock and the lowest price that a seller is willing to sell it for. LPTY stock has a narrow bid-ask spread, which means that there is a small difference between the price that buyers are willing to pay and the price that sellers are willing to sell it for. This makes it easy for investors to buy or sell LPTY stock without incurring a large trading cost.

- Title of Facet 3: Market depth

Market depth refers to the number of shares that are available to be bought or sold at each price level. LPTY stock has a deep market, which means that there is a large number of shares available to be bought or sold at each price level. This makes it easy for investors to buy or sell large blocks of LPTY stock without significantly affecting its price.

Overall, LPTY stock is a liquid asset that can be easily bought or sold without significantly affecting its price. This makes it a good option for investors who want to be able to access their money quickly.

Transparent

Transparency is an important factor to consider when investing in any fund. A transparent fund is one that provides investors with regular and detailed information about its holdings and performance. LPTY stock is a transparent fund because it provides investors with access to a wide range of information, including:

- The fund's investment objective

- The fund's investment strategy

- The fund's portfolio holdings

- The fund's performance history

- The fund's fees and expenses

This information is important for investors because it allows them to make informed decisions about whether or not to invest in the fund. For example, an investor can use the fund's investment objective and strategy to determine if the fund is aligned with their own investment goals. An investor can also use the fund's portfolio holdings to determine if the fund is invested in the types of companies that they are interested in. Finally, an investor can use the fund's performance history to determine if the fund has been able to achieve its investment objectives.

Transparency is an important component of LPTY stock because it allows investors to make informed decisions about whether or not to invest in the fund. LPTY stock is a transparent fund because it provides investors with access to a wide range of information about its holdings and performance.

FAQs about LPTY Stock

This section provides answers to frequently asked questions about LPTY stock, an exchange-traded fund (ETF) that tracks the performance of the S&P 500 index.

Question 1: What is LPTY stock?

Answer: LPTY stock is an ETF that tracks the performance of the S&P 500 index. This means that it invests in the same companies that make up the S&P 500 index, in the same proportions.

Question 2: What are the benefits of investing in LPTY stock?

Answer: There are several benefits to investing in LPTY stock, including diversification, low cost, and long-term growth potential. LPTY stock is diversified because it invests in a wide range of companies, which helps to reduce risk. LPTY stock also has a low expense ratio, which means that investors can keep more of their returns. Finally, LPTY stock has a long-term track record of growth, which makes it a good option for investors who are looking for a long-term investment.

Summary of key takeaways or final thought: LPTY stock is a diversified, low-cost, and long-term investment option that tracks the performance of the S&P 500 index. It is a good choice for investors who are looking for a single investment that provides exposure to the U.S. stock market.

Conclusion

LPTY stock is a diversified, low-cost, and long-term investment option that tracks the performance of the S&P 500 index. It is a good choice for investors who are looking for a single investment that provides exposure to the U.S. stock market.

LPTY stock has a number of advantages over other investment options. First, it is diversified, which means that it invests in a wide range of companies. This helps to reduce risk. Second, LPTY stock has a low expense ratio, which means that investors can keep more of their returns. Third, LPTY stock has a long-term track record of growth, which makes it a good option for investors who are looking for a long-term investment.

Overall, LPTY stock is a good investment option for investors who are looking for a diversified, low-cost, and long-term investment.

Remembering George O'Malley: A Tragic Death On Grey's Anatomy

The Unbelievable Journey Of David Letterman: Exploring His Age And Legacy

Jillian Fink Age: Find Out How Old She Is

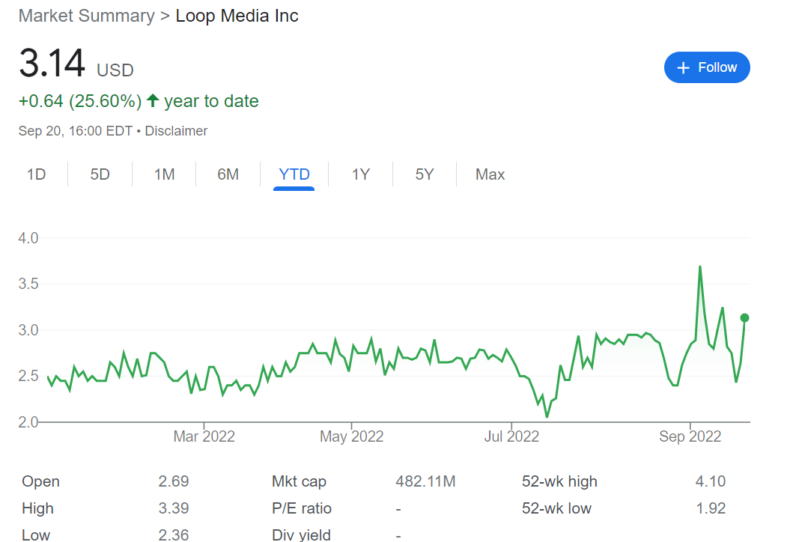

Buy Loop Media Inc Stock LPTV Stock Price Today & News

Uplisting Review For Loop Media LPTV Stock, Moomoo Trade YouTube

Loop Media Upgrades To NYSE And Falls 60 In Price?