Why Did My Credit Card Disappear From The Citibank App? A Comprehensive Guide

Have you ever opened your Citibank app only to find that your credit card has mysteriously disappeared? If so, you're not alone. This issue has left many Citibank customers puzzled and anxious, especially when they rely on the app for managing their finances. Whether you're a long-time Citibank user or a new customer, understanding why this happens and how to resolve it is crucial for maintaining peace of mind and financial control.

There are several reasons why your credit card might no longer appear in the Citibank app. These could range from technical glitches to account-related issues. In some cases, it may even be a security measure put in place by the bank to protect your account. Regardless of the cause, it’s essential to address the problem promptly to avoid any disruptions in accessing your financial information.

In this article, we will delve into the possible reasons behind this issue, provide actionable steps to resolve it, and offer tips to prevent it from happening again. By the end of this guide, you'll have a clear understanding of what to do if your credit card disappears from the Citibank app, ensuring you can manage your finances with confidence.

Read also:Nicolle Wallaces Education A Deeper Dive

Table of Contents

- Common Reasons Why Your Credit Card Disappears

- Technical Glitches and App Updates

- Account-Related Issues

- Security Measures and Fraud Prevention

- Steps to Resolve the Issue

- How to Contact Citibank Support

- Tips to Prevent Future Occurrences

- Alternative Ways to Access Your Credit Card Information

- Statistics on Mobile Banking App Issues

- Conclusion and Next Steps

Common Reasons Why Your Credit Card Disappears

When your credit card disappears from the Citibank app, it can be alarming. However, there are several common reasons for this occurrence. One possibility is a technical glitch within the app itself. These glitches can arise from bugs, outdated software, or compatibility issues with your device.

Another common cause is account-related issues. For instance, if your credit card has expired, been canceled, or is temporarily suspended due to suspicious activity, it may no longer appear in the app. Citibank may also remove cards from the app if there are discrepancies in account information or if the card is linked to another user's profile.

Finally, security measures can play a role. Citibank employs advanced fraud detection systems to protect customers. If the system detects unusual activity, it may temporarily hide your card or require additional verification steps. Understanding these potential causes is the first step toward resolving the issue.

Technical Glitches and App Updates

Technical glitches are a frequent culprit when it comes to credit cards disappearing from the Citibank app. These glitches can occur due to a variety of reasons, such as outdated app versions, server downtime, or bugs in the app's code. To address this, ensure that your Citibank app is always updated to the latest version available on your device's app store.

Another factor to consider is device compatibility. Some older devices may not support the latest features of the Citibank app, leading to display issues. If you're using an older smartphone or tablet, try accessing the app from a different device to see if the problem persists. Additionally, clearing the app's cache can often resolve minor technical issues.

If the problem continues despite these efforts, it may be worth reaching out to Citibank's customer support team. They can provide insights into whether the issue is widespread and offer specific solutions tailored to your situation.

Read also:Marcandre Fleurys Wife All About Veronique Fleury

How to Clear Cache in the Citibank App

- Go to your device's settings.

- Locate the Citibank app in the list of installed applications.

- Tap on "Storage" and select "Clear Cache."

- Reopen the app and check if the issue is resolved.

Account-Related Issues

Account-related issues are another common reason why your credit card might disappear from the Citibank app. For example, if your credit card has expired, Citibank will automatically remove it from the app until you request a replacement. Similarly, if your card has been canceled or suspended due to non-payment or other reasons, it will no longer appear in the app.

Another possibility is that your account information is outdated or incorrect. This can happen if you recently moved and failed to update your address or if there are discrepancies in your personal details. Citibank may temporarily hide your card until these issues are resolved to ensure the security of your account.

To address account-related issues, log in to your Citibank online account and review your account details. Ensure that all information is accurate and up to date. If you suspect that your card has been canceled or suspended, contact Citibank's customer support team for clarification and assistance.

Steps to Update Your Account Information

- Log in to your Citibank online account.

- Navigate to the "Profile" or "Account Settings" section.

- Update your address, phone number, or other relevant details.

- Save your changes and confirm the updates.

Security Measures and Fraud Prevention

Citibank takes security very seriously, and one of the ways they protect customers is by implementing advanced fraud detection systems. If the system detects unusual activity on your account, it may temporarily hide your credit card from the app as a precautionary measure. This could include transactions in unfamiliar locations, large purchases, or multiple failed login attempts.

In some cases, Citibank may require additional verification steps before restoring access to your card. This could involve answering security questions, providing a one-time passcode sent to your registered phone number, or verifying your identity through a customer service representative.

While these measures can be inconvenient, they are designed to protect your financial information and prevent unauthorized access. If you believe your card has been hidden due to a false positive, contact Citibank immediately to resolve the issue.

Steps to Resolve the Issue

If your credit card has disappeared from the Citibank app, there are several steps you can take to resolve the issue. First, check if the problem is related to a technical glitch. Ensure that your app is updated, clear the cache, and try accessing the app from a different device if necessary.

Next, review your account information for any discrepancies. Update your details if needed and confirm that your card is still active. If you suspect that your card has been canceled or suspended, contact Citibank's customer support team for clarification.

Finally, if you believe the issue is related to security measures, follow the verification steps provided by Citibank. This may involve answering security questions or providing additional documentation to confirm your identity. By taking these steps, you can quickly restore access to your credit card and ensure your financial information remains secure.

How to Contact Citibank Support

If you're unable to resolve the issue on your own, contacting Citibank's customer support team is the next best step. Citibank offers multiple channels for customer support, including phone, email, and live chat. Their representatives are trained to assist with a wide range of issues, including credit card discrepancies in the app.

To contact Citibank, start by visiting their official website and navigating to the "Contact Us" section. From there, you can choose your preferred method of communication. If you opt for phone support, be sure to have your account details and any relevant information handy to expedite the process.

Additionally, Citibank's support team can provide updates on any ongoing technical issues or app outages. This can help you determine whether the problem is widespread or specific to your account.

Tips to Prevent Future Occurrences

To minimize the chances of your credit card disappearing from the Citibank app in the future, there are several proactive steps you can take. First, regularly update the app to the latest version to ensure you have access to the most recent features and security patches.

Second, keep your account information up to date. This includes your address, phone number, and email address. Citibank may hide your card if there are discrepancies in your details, so it's important to review and update them periodically.

Finally, monitor your account for any unusual activity. If you notice suspicious transactions or login attempts, report them to Citibank immediately. By staying vigilant and proactive, you can reduce the likelihood of encountering this issue again.

Alternative Ways to Access Your Credit Card Information

If your credit card is temporarily unavailable in the Citibank app, there are alternative ways to access your account information. One option is to log in to your Citibank online account through a web browser. This platform offers the same features as the app and allows you to view your credit card details, transactions, and account statements.

Another alternative is to use Citibank's customer service phone line. Their representatives can provide real-time updates on your account status and assist with any issues you may be experiencing. Additionally, you can request paper statements or account summaries to be mailed to your address if needed.

While these alternatives may not be as convenient as the app, they ensure you can still manage your finances effectively until the issue is resolved.

Statistics on Mobile Banking App Issues

Mobile banking apps have become an essential tool for managing finances, but they are not without their challenges. According to a 2022 survey by J.D. Power, approximately 15% of mobile banking users reported experiencing technical issues with their banking apps in the past year. Common problems included app crashes, slow performance, and login difficulties.

Another study by Accenture found that 22% of users encountered issues related to account synchronization, such as missing transactions or incorrect balances. These statistics highlight the importance of having a reliable support system in place to address these issues promptly.

By understanding the prevalence of mobile banking app issues, customers can take proactive steps to mitigate potential problems. Regularly updating the app, monitoring account activity, and maintaining open communication with the bank are key strategies for ensuring a seamless banking experience.

Conclusion and Next Steps

In conclusion, discovering that your credit card has disappeared from the Citibank app can be unsettling, but it is often a solvable issue. Whether the cause is a technical glitch, account-related problem, or security measure, understanding the potential reasons and taking appropriate action can help you regain access to your financial information.

We encourage you to follow the steps outlined in this guide to resolve the issue and prevent it from happening again. If you found this article helpful, please consider sharing it with others who may benefit from the information. Additionally, feel free to leave a comment below with your experiences or questions—we’d love to hear from you!

For more tips on managing your finances and navigating banking apps, explore our other articles on financial literacy and digital banking. Stay informed, stay proactive, and take control of your financial future today.

DVOK Canvas Gel: The Ultimate Solution For Modern Artists

Clio Magnet Pact: The Ultimate Guide To Achieving A Flawless Finish

Ford Field Club Level: The Ultimate Game-Day Experience

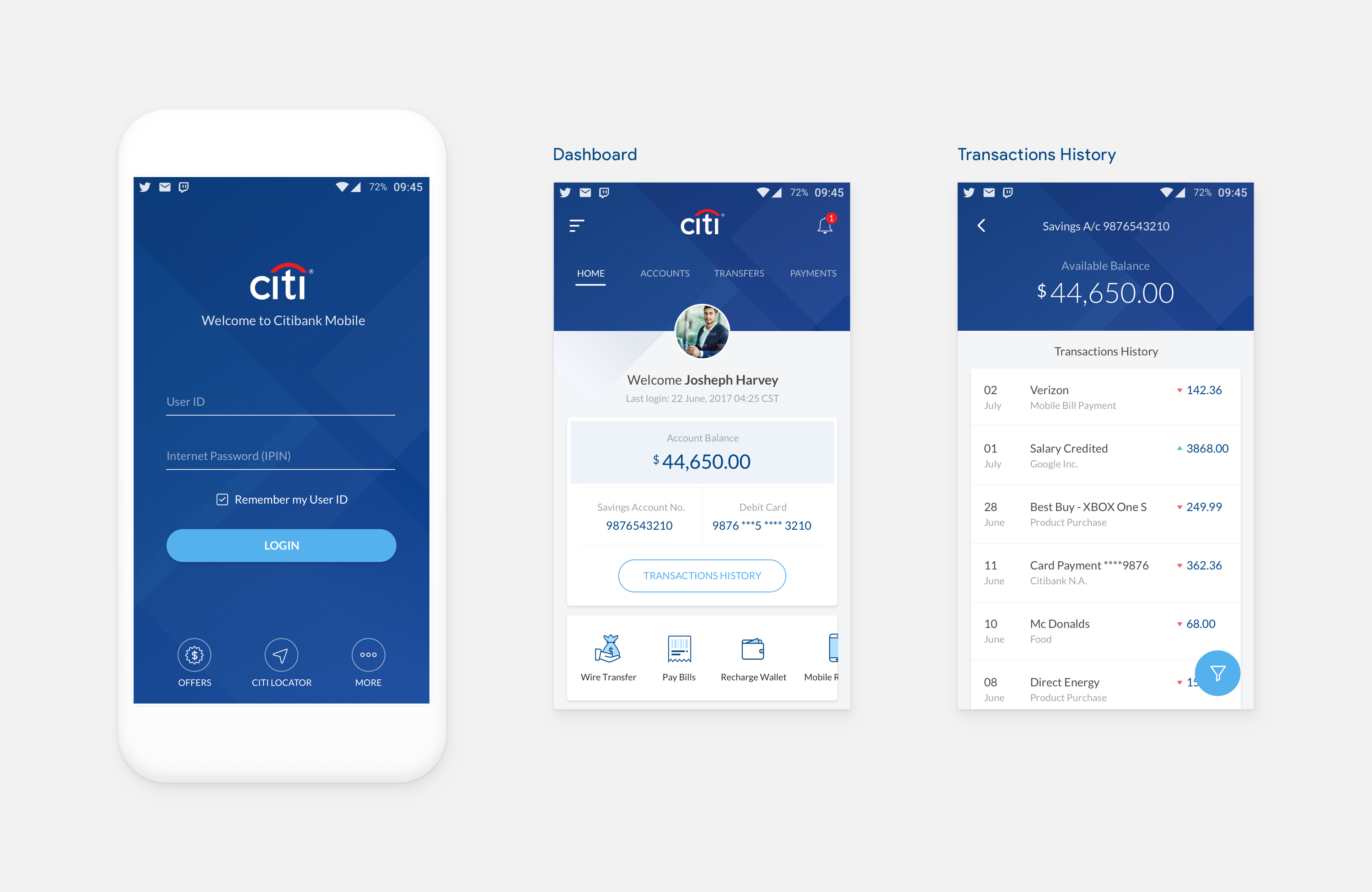

Dribbble citibank_artwork.png by Manish Jain

Citibank App on Behance