Revolutionary Row Wells Fargo: Understanding The Impact And Implications

Table of Contents

- Introduction

- What is Revolutionary Row Wells Fargo?

- Historical Context of Wells Fargo

- Key Events Leading to the Revolutionary Row

- The Role of Technology in the Row

- Regulatory Challenges Faced by Wells Fargo

- Impact on Customers

- Lessons Learned from the Revolutionary Row

- Future Outlook for Wells Fargo

- Conclusion

Introduction

Revolutionary Row Wells Fargo has become a pivotal topic in the financial industry, sparking discussions about corporate governance, customer trust, and regulatory compliance. This article delves into the intricacies of the Revolutionary Row and its far-reaching implications for one of America's oldest financial institutions.

Over the years, Wells Fargo has faced numerous challenges that have tested its resilience and adaptability. The Revolutionary Row is a culmination of these challenges, highlighting systemic issues that have plagued the organization. Understanding the context and consequences of this row is crucial for anyone interested in the financial sector or corporate accountability.

In this article, we will explore the historical background of Wells Fargo, the key events that led to the Revolutionary Row, and its impact on customers and stakeholders. We will also discuss the role of technology, regulatory challenges, and the lessons learned from this tumultuous period. By the end, you will have a comprehensive understanding of the Revolutionary Row and its significance in today's financial landscape.

Read also:Unmissable Films Starring Hollywood Legend Kurt Russell

What is Revolutionary Row Wells Fargo?

The term "Revolutionary Row Wells Fargo" refers to a series of scandals, controversies, and regulatory actions that have rocked Wells Fargo in recent years. These incidents have exposed deep-rooted issues within the organization, leading to widespread public outcry and calls for reform.

At the heart of the Revolutionary Row is the infamous fake accounts scandal, where employees were found to have opened millions of unauthorized accounts in customers' names. This scandal not only tarnished Wells Fargo's reputation but also led to significant financial penalties and leadership changes.

Key factors contributing to the Revolutionary Row include:

- Aggressive sales targets and unethical practices

- Lack of oversight and accountability

- Failure to prioritize customer interests

These factors have resulted in a loss of trust among customers and investors, prompting calls for a fundamental overhaul of the company's operations and culture.

Historical Context of Wells Fargo

Wells Fargo, founded in 1852, has a rich history as one of the oldest and most respected financial institutions in the United States. Originally established to provide banking and express services during the California Gold Rush, the company has evolved into a global financial powerhouse.

Early Years and Growth

During its early years, Wells Fargo played a crucial role in the development of the American West. The company's stagecoach services and banking operations helped facilitate commerce and communication across the frontier.

Read also:Anna Shumate Influencer Spotlight

Modern Era

In the 20th century, Wells Fargo expanded its services to include retail banking, mortgage lending, and investment management. By the early 2000s, the company had become one of the largest banks in the United States, with a strong presence in both consumer and commercial markets.

Despite its storied history, Wells Fargo's reputation has been marred by a series of scandals in recent years, culminating in the Revolutionary Row. Understanding this historical context is essential for comprehending the magnitude of the challenges faced by the company today.

Key Events Leading to the Revolutionary Row

The Revolutionary Row Wells Fargo did not occur overnight. It was the result of a series of events and decisions that gradually eroded trust in the institution. Here are some of the most significant events leading up to the row:

Fake Accounts Scandal

In 2016, Wells Fargo was fined $185 million by regulators after it was discovered that employees had opened millions of unauthorized accounts in customers' names. This scandal exposed a culture of aggressive sales tactics and unethical behavior within the company.

Auto Insurance Scandal

In 2017, it was revealed that Wells Fargo had improperly charged customers for auto insurance they did not need. This led to the repossession of thousands of vehicles and further damaged the company's reputation.

Mortgage Lending Issues

Wells Fargo faced additional scrutiny over its mortgage lending practices, including allegations of improperly charging fees and modifying loan terms without customer consent.

These events, combined with regulatory actions and public backlash, set the stage for the Revolutionary Row, which has forced Wells Fargo to undergo significant changes in its operations and corporate culture.

The Role of Technology in the Row

Technology has played a dual role in the Revolutionary Row Wells Fargo. On one hand, it has been a source of challenges, while on the other, it has offered potential solutions for addressing the issues faced by the company.

Challenges Posed by Technology

The rise of digital banking has increased the complexity of financial operations, making it more difficult for companies like Wells Fargo to maintain oversight and control. Additionally, the reliance on automated systems has sometimes led to errors and mismanagement, exacerbating existing issues.

Opportunities for Improvement

Despite these challenges, technology also offers opportunities for Wells Fargo to improve its operations and rebuild trust. Key technological advancements include:

- Enhanced data analytics to detect and prevent fraudulent activities

- Improved customer service through AI-driven chatbots and support systems

- Blockchain technology for secure and transparent transactions

By leveraging these technologies, Wells Fargo can address some of the root causes of the Revolutionary Row and work towards a more sustainable future.

Regulatory Challenges Faced by Wells Fargo

One of the most significant aspects of the Revolutionary Row Wells Fargo is the intense regulatory scrutiny the company has faced. Regulatory challenges have played a crucial role in shaping the outcome of the row and influencing the company's response.

Regulatory Actions

In response to the fake accounts scandal and other controversies, regulators have imposed a range of penalties and restrictions on Wells Fargo. These include:

- Fines and settlements totaling billions of dollars

- Asset cap restrictions limiting the company's growth

- Increased oversight and reporting requirements

Impact on Operations

The regulatory actions have forced Wells Fargo to make significant changes in its operations, including:

- Revising sales practices and incentives

- Implementing stricter compliance measures

- Enhancing transparency and accountability

While these measures have been necessary to address the issues at hand, they have also posed challenges for the company's ability to compete in a rapidly changing financial landscape.

Impact on Customers

The Revolutionary Row Wells Fargo has had a profound impact on the company's customers, affecting their trust, financial well-being, and overall experience with the institution.

Loss of Trust

One of the most significant consequences of the Revolutionary Row is the erosion of trust among Wells Fargo's customer base. Many customers have expressed concerns about the safety and security of their accounts, leading to a decline in customer loyalty and retention.

Financial Consequences

Customers affected by the fake accounts scandal and other controversies have faced financial repercussions, including:

- Unauthorized fees and charges

- Damage to credit scores

- Legal and administrative costs associated with resolving disputes

Steps Taken by Wells Fargo

In response to these challenges, Wells Fargo has implemented several measures to address customer concerns and rebuild trust, including:

- Compensation programs for affected customers

- Improved customer service and support

- Enhanced transparency in communication

While these efforts have helped mitigate some of the negative impacts, restoring full trust will require sustained commitment and action from the company.

Lessons Learned from the Revolutionary Row

The Revolutionary Row Wells Fargo offers several important lessons for other financial institutions and organizations facing similar challenges. These lessons highlight the importance of ethical practices, transparency, and accountability in maintaining trust and ensuring long-term success.

Importance of Ethical Practices

One of the key takeaways from the Revolutionary Row is the critical importance of ethical practices in business operations. Companies must prioritize customer interests and ensure that their employees adhere to high ethical standards.

Need for Transparency

Transparency is another crucial lesson from the Revolutionary Row. Organizations must be open and honest in their dealings with customers, regulators, and stakeholders to build and maintain trust.

Accountability and Oversight

Effective accountability and oversight mechanisms are essential for preventing unethical behavior and ensuring compliance with regulations. Companies should implement robust systems for monitoring and addressing potential issues before they escalate.

By learning from these lessons, organizations can avoid the pitfalls that led to the Revolutionary Row and create a more sustainable and trustworthy business environment.

Future Outlook for Wells Fargo

As Wells Fargo continues to navigate the aftermath of the Revolutionary Row, the company faces both challenges and opportunities for growth and transformation. The future outlook for Wells Fargo will depend on its ability to address past issues and adapt to a rapidly changing financial landscape.

Strategic Initiatives

Wells Fargo has announced several strategic initiatives aimed at rebuilding trust and improving its operations, including:

- Investing in digital transformation and innovation

- Enhancing customer experience through personalized services

- Strengthening risk management and compliance frameworks

Market Position

Despite the challenges posed by the Revolutionary Row, Wells Fargo remains a major player in the financial industry. Its strong brand recognition and extensive customer base provide a solid foundation for future growth.

Regulatory Environment

The regulatory environment will continue to play a significant role in shaping Wells Fargo's future. The company must remain vigilant in adhering to regulatory requirements and addressing any emerging issues to avoid further penalties and restrictions.

By focusing on these areas, Wells Fargo can position itself for long-term success and regain its status as a trusted financial institution.

Conclusion

The Revolutionary Row Wells Fargo has been a defining moment for the financial industry, highlighting the importance of ethical practices, transparency, and accountability. This article has explored the historical context, key events, and impact of the row, as well as the lessons learned and future outlook for Wells Fargo.

As Wells Fargo continues to rebuild trust and transform its operations, it serves as a reminder of the critical role that integrity and customer-centricity play in sustaining a successful business. By learning from the Revolutionary Row, other organizations can avoid similar pitfalls and create a more trustworthy and resilient business environment.

We encourage you to share your thoughts and insights on the Revolutionary Row Wells Fargo in the comments below. Additionally, feel free to explore other articles on our site to stay informed about the latest developments in the financial industry.

Authentic Talbina Recipe: A Traditional Dish With Healing Properties

Discover The Allure Of Erin Taylor Necklaces: A Timeless Accessory For Every Occasion

Essence Lipliner 202: The Ultimate Guide To Achieving Perfect Lips

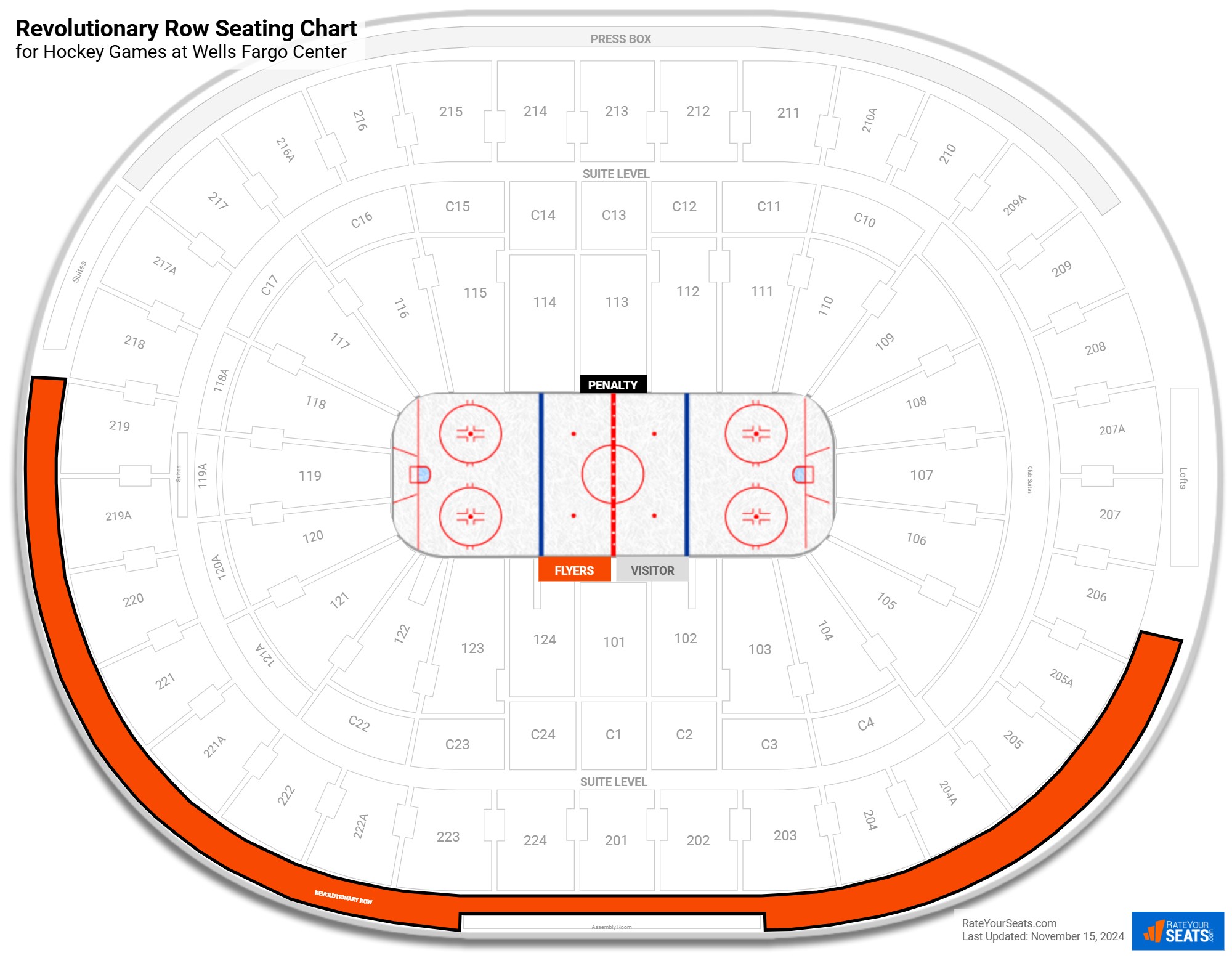

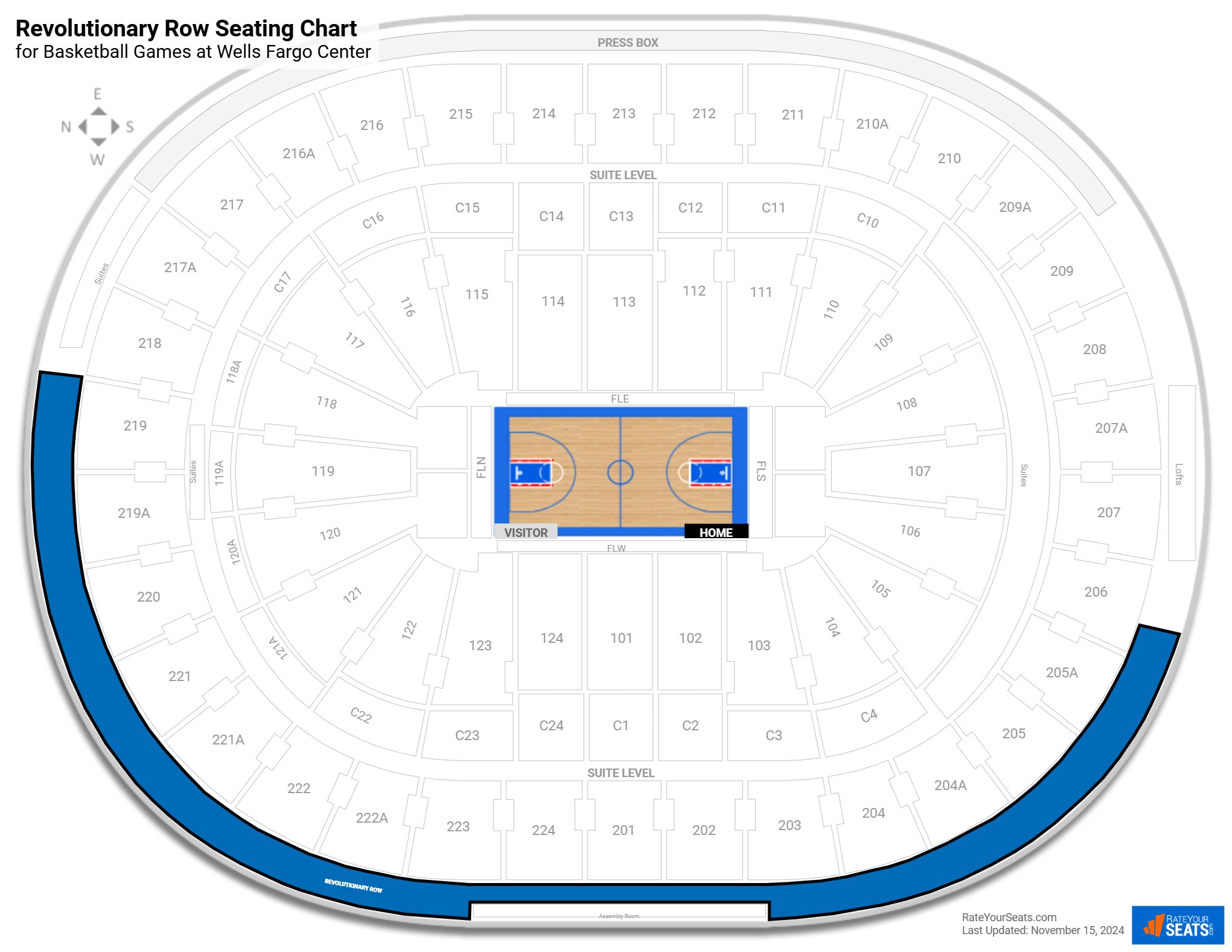

Wells Fargo Center Revolutionary Row

Wells Fargo Center Revolutionary Row