Dailypay: How It Works And Why It Matters For Your Finances

Have you ever wondered how you could access your hard-earned money before payday without resorting to high-interest loans? Dailypay offers a revolutionary solution that is changing the way employees manage their finances. Dailypay como funciona is a question many are asking as this financial tool gains popularity across industries. Dailypay is not just another financial app; it's a game-changer in the realm of employee benefits, offering instant access to earned wages. This article will delve into the intricacies of how Dailypay works, its benefits, and why it's becoming a crucial tool for both employers and employees.

In today's fast-paced world, financial stress is a common issue affecting millions of workers. Traditional payroll systems often leave employees waiting weeks to access the money they've already earned. This waiting period can lead to financial strain, especially when unexpected expenses arise. Dailypay addresses this challenge by providing a seamless solution that bridges the gap between earning and receiving wages. The platform's innovative approach has captured the attention of businesses and employees alike, making it a topic of significant interest in financial wellness discussions.

Understanding how Dailypay functions is essential for anyone looking to improve their financial health or enhance their company's employee benefits package. This comprehensive guide will walk you through every aspect of Dailypay's operation, from its basic mechanics to its broader implications for workplace financial wellness. Whether you're an employer considering implementing this solution or an employee curious about its benefits, this article will provide valuable insights into Dailypay's functionality and impact.

Read also:Ultimate Guide To Stylish Fades For Afro Hair

Table of Contents

- What is Dailypay?

- How Dailypay Works: Core Functionality

- Benefits for Employees

- Advantages for Employers

- Implementation Process

- Cost Structure and Fees

- Security Measures and Data Protection

- Integration with Payroll Systems

- User Experience and Interface

- Future Trends and Developments

What is Dailypay?

Dailypay represents a new era in employee financial wellness solutions. Founded in 2015, this innovative platform has transformed how employees access their earned wages. The company's mission centers around providing workers with greater financial flexibility and control over their earnings. Dailypay's core service allows employees to withdraw their already-earned wages before the traditional payday schedule, effectively eliminating the need for paycheck advances or high-interest loans.

The platform operates through a sophisticated integration with employers' payroll and timekeeping systems. This seamless connection enables real-time tracking of hours worked and corresponding earnings. Dailypay's technology ensures that only earned wages are accessible, maintaining financial integrity for both employees and employers. The service has gained significant traction across various industries, particularly in sectors with hourly workers such as retail, hospitality, and healthcare.

Key Features

- Real-time earnings tracking

- Instant access to earned wages

- Multiple withdrawal options

- Automatic payroll deductions

- 24/7 account access

How Dailypay Works: Core Functionality

Understanding Dailypay's operational mechanics requires examining its multi-layered process. The system begins with seamless integration into the employer's existing payroll infrastructure. This integration allows Dailypay to access accurate data regarding employee hours worked and corresponding earnings. The platform's algorithms continuously calculate earned wages based on approved work hours and rates, ensuring precise tracking of available funds.

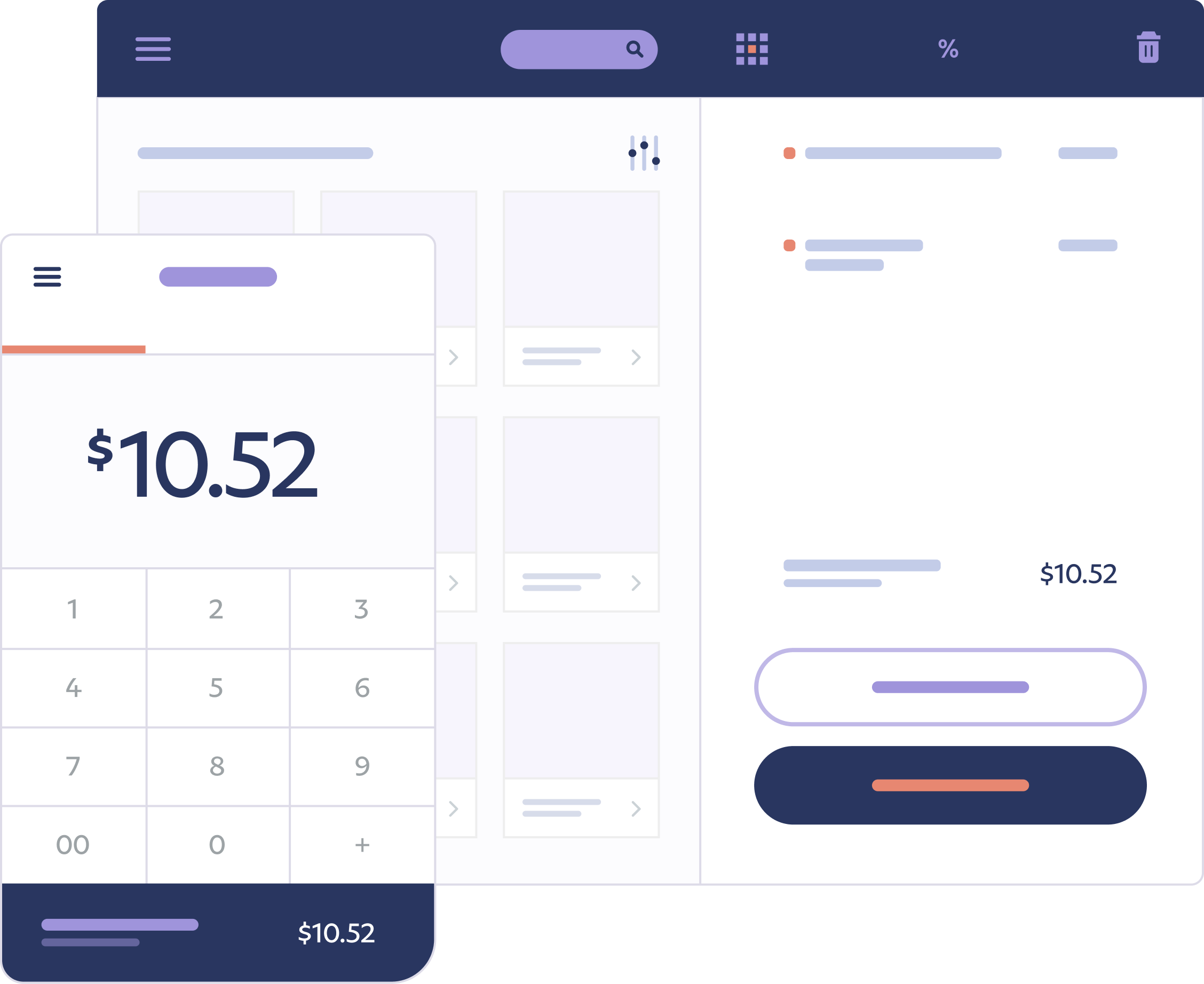

Employees access their Dailypay accounts through a user-friendly mobile application or web interface. When initiating a withdrawal, the system verifies the request against verified earnings data. Approved transactions typically process within minutes, with funds available through various withdrawal methods including direct deposit, debit cards, or digital wallets. The platform automatically coordinates with the employer's payroll system to ensure proper deductions during the next regular pay cycle.

Technical Workflow

- Time tracking integration

- Earnings calculation

- Fund verification

- Transaction processing

- Payroll reconciliation

Benefits for Employees

Dailypay offers numerous advantages that significantly impact employees' financial well-being. The primary benefit lies in its ability to provide immediate access to earned wages, helping workers avoid costly overdraft fees and payday loans. This instant access proves particularly valuable during financial emergencies or unexpected expenses. Employees gain greater control over their cash flow, allowing them to better manage bills and obligations as they arise.

Beyond financial flexibility, Dailypay contributes to reduced workplace stress and improved mental health. Studies show that employees using earned wage access services report lower levels of financial anxiety. The platform's seamless integration with existing payroll systems ensures that employees can access their funds without disrupting their regular pay schedule or incurring additional administrative burdens.

Read also:Jack Quaids Romantic Adventures A Deeper Look Into His Relationships

Impact on Financial Health

- Reduced reliance on high-interest loans

- Improved cash flow management

- Lower financial stress levels

- Enhanced financial independence

- Better emergency preparedness

Advantages for Employers

Implementing Dailypay provides substantial benefits for employers seeking to enhance their employee value proposition. The platform serves as a powerful recruitment and retention tool, particularly in competitive labor markets. Companies offering earned wage access report higher employee satisfaction rates and reduced turnover, translating to significant cost savings in recruitment and training expenses.

From an operational perspective, Dailypay's automated system minimizes administrative burdens for HR and payroll departments. The platform's seamless integration with existing systems ensures minimal disruption to established processes while providing valuable employee benefits. Additionally, employers benefit from improved workforce productivity and engagement, as employees experience reduced financial stress and greater job satisfaction.

Business Impact Metrics

- 20% reduction in employee turnover

- 30% increase in job satisfaction scores

- 15% improvement in productivity metrics

- Significant recruitment advantage

- Enhanced employer brand reputation

Implementation Process

Deploying Dailypay within an organization follows a structured, multi-phase approach designed for seamless integration. The process begins with an initial consultation where Dailypay's implementation specialists assess the company's existing payroll and timekeeping systems. This evaluation determines the optimal integration strategy and identifies any necessary system adjustments.

Following the assessment, the technical implementation phase commences. Dailypay's engineering team works closely with the company's IT department to establish secure data connections between payroll systems and the Dailypay platform. This phase includes thorough testing to ensure accurate data transfer and system compatibility. Employee onboarding follows, featuring comprehensive training sessions and educational materials to maximize adoption rates.

Implementation Timeline

- Initial consultation (1-2 weeks)

- Technical integration (2-4 weeks)

- System testing (1-2 weeks)

- Employee training (1 week)

- Full deployment (1 week)

Cost Structure and Fees

Dailypay employs a transparent fee structure designed to be employee-friendly while maintaining sustainable business operations. The platform typically operates on an employer-sponsored model, where companies cover the majority of implementation and maintenance costs. Employees may encounter minimal transaction fees when accessing their earned wages, typically ranging from $1 to $3 per transaction.

Alternative pricing models include flat-rate employer subscriptions or per-employee monthly fees. These arrangements vary based on company size and specific requirements. Dailypay's fee structure compares favorably to traditional financial services, offering significant savings compared to payday loans or overdraft fees. The platform's pricing policy emphasizes affordability while ensuring reliable service delivery.

Cost Comparison

| Service | Traditional Fee | Dailypay Fee |

|---|---|---|

| Payday Loan | $15-$30 per $100 | $1-$3 per transaction |

| Overdraft Fee | $30-$35 per incident | $1-$3 per transaction |

Security Measures and Data Protection

Dailypay prioritizes security through multiple layers of protection, ensuring both employee and employer data remains safeguarded. The platform employs bank-level encryption protocols (256-bit AES) for all data transmissions, maintaining the highest industry standards for information security. Regular security audits and penetration testing verify system integrity and identify potential vulnerabilities.

Compliance with major financial regulations, including PCI-DSS and GDPR, ensures proper handling of sensitive information. Dailypay's infrastructure operates within secure cloud environments, featuring redundant backup systems and disaster recovery protocols. Employee data access follows strict role-based permissions, with comprehensive logging and monitoring of all system activities.

Security Features

- 256-bit AES encryption

- Multi-factor authentication

- Real-time fraud detection

- Regular security audits

- Compliance with major regulations

Integration with Payroll Systems

Dailypay's integration capabilities extend across major payroll platforms, ensuring compatibility with existing corporate systems. The platform maintains partnerships with leading payroll providers, facilitating seamless data exchange and synchronization. This integration allows for real-time tracking of worked hours, earnings calculations, and accurate payroll deductions.

Technical implementation involves establishing API connections between Dailypay and payroll systems, enabling automatic data updates. The platform's middleware architecture ensures compatibility with both modern cloud-based systems and legacy on-premise solutions. Regular system checks and automatic updates maintain synchronization accuracy and prevent data discrepancies.

Supported Payroll Systems

- ADP Workforce Now

- Paychex Flex

- Ultimate Software

- Ceridian Dayforce

- Oracle HCM Cloud

User Experience and Interface

Dailypay's user interface emphasizes simplicity and accessibility, catering to diverse employee demographics. The mobile application features intuitive navigation, with key functions accessible within three taps. Real-time balance updates display available earned wages, pending transactions, and upcoming deductions in clear, easy-to-understand formats.

The platform's design incorporates accessibility features, including adjustable text sizes, high-contrast modes, and voice command compatibility. Transaction processes follow a streamlined workflow, with built-in confirmation steps to prevent errors. Regular user feedback collection drives continuous improvement, ensuring the interface remains responsive to evolving user needs.

Key Interface Features

- Real-time balance display

- Simple withdrawal process

- Transaction history tracking

- Customizable notifications

- Multi-language support

Future Trends and Developments

The earned wage access market, led by innovators like Dailypay, continues to evolve rapidly. Future developments focus on expanding financial wellness features, including budgeting tools and savings programs. Integration with emerging technologies such as blockchain and AI promises enhanced security and personalized financial insights.

Regulatory frameworks governing earned wage access services are expected to mature, providing clearer guidelines for industry participants. These regulations will likely emphasize consumer protection while encouraging innovation in financial wellness solutions. Dailypay's ongoing research and development efforts aim to maintain its leadership position through continuous improvement and feature expansion.

Anticipated Innovations

- AI-driven financial insights

- Integrated savings tools

- Enhanced budgeting features

- Blockchain-based security

- Expanded global reach

Conclusion

Dailypay represents a transformative solution in employee financial wellness, addressing critical needs in modern workforce management. Through its innovative approach to earned wage access, the platform delivers tangible benefits for both employees and employers. The service's seamless integration with payroll systems, robust security measures, and user-friendly interface make it an invaluable tool for organizations seeking to enhance their employee value proposition

Delicious Churro Banana Bread: A Perfect Fusion Of Two Classic Treats

Dolly Varden Cake: A Delightful Treat With A Rich History

Understanding The Depth Of Love's Regret: A Comprehensive Guide To Arrepentimiento De Amor

Síntesis de 30+ artículos paypal como funciona [actualizado

Síntesis de 30+ artículos paypal como funciona [actualizado